The golden years are a time for cherished moments and new adventures, but financial planning is still essential. As seniors age, they may find themselves reevaluating their insurance needs, and term life insurance can be a valuable tool for securing their legacy and protecting loved ones. But with age comes a complex landscape of premiums and factors that can impact rates. Understanding how term life insurance rates for seniors are calculated and what strategies can help optimize affordability is key to making informed decisions.

This guide delves into the intricacies of term life insurance for seniors, exploring the key factors that influence rates, common misconceptions, and strategies for finding affordable coverage. We’ll also examine alternative insurance options and resources available to help seniors navigate this process.

Understanding Term Life Insurance for Seniors

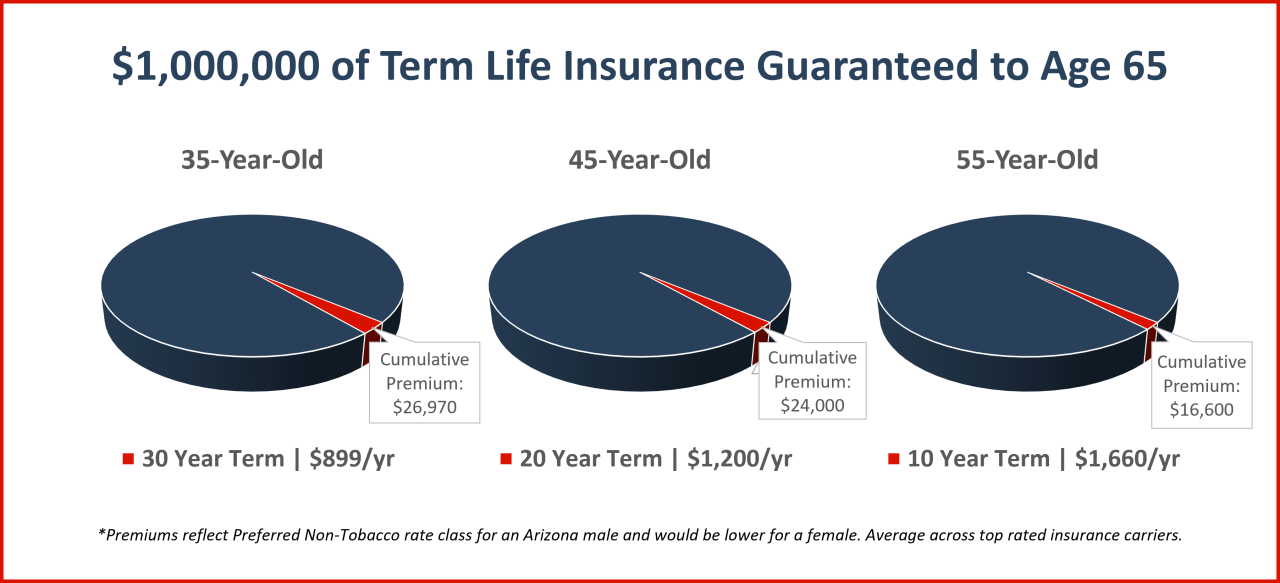

Term life insurance is a type of life insurance that provides coverage for a specific period, typically 10, 20, or 30 years. It’s designed to protect your loved ones financially if you pass away during the policy term. While often associated with younger individuals, term life insurance can also be a valuable tool for seniors, offering financial security and peace of mind during their later years.

Benefits of Term Life Insurance for Seniors

Term life insurance can provide numerous benefits for seniors, particularly in different life stages.

- Final Expenses: As seniors age, they may face increasing medical expenses, funeral costs, and other end-of-life expenses. Term life insurance can provide a lump-sum payout to cover these expenses, relieving the financial burden on their loved ones.

- Debt Coverage: Many seniors have outstanding debts, such as mortgages, credit card balances, or medical bills. Term life insurance can help pay off these debts, ensuring their loved ones aren’t left with a financial burden.

- Estate Planning: Term life insurance can be a valuable tool for estate planning. It can help ensure that your loved ones receive a financial inheritance, even if you pass away before you have a chance to build a substantial estate.

- Peace of Mind: Knowing that your loved ones are financially protected in the event of your passing can provide peace of mind for both you and your family.

Common Misconceptions About Term Life Insurance for Seniors

There are several common misconceptions about term life insurance for seniors, which can prevent them from exploring this valuable option.

- “It’s too expensive.” While premiums can vary based on factors like age, health, and coverage amount, term life insurance can be more affordable than you might think. Many insurers offer competitive rates for seniors, and there are options to tailor the coverage to your specific needs and budget.

- “I’m too old to get coverage.” This is not true. Most insurers offer term life insurance to seniors, although the maximum age for coverage may vary. You can still obtain a policy, even if you are in your 70s or 80s.

- “I don’t need it because I don’t have any dependents.” Even if you don’t have dependents, term life insurance can still be beneficial for covering final expenses and relieving your loved ones of the financial burden of your passing.

Factors Affecting Term Life Insurance Rates for Seniors

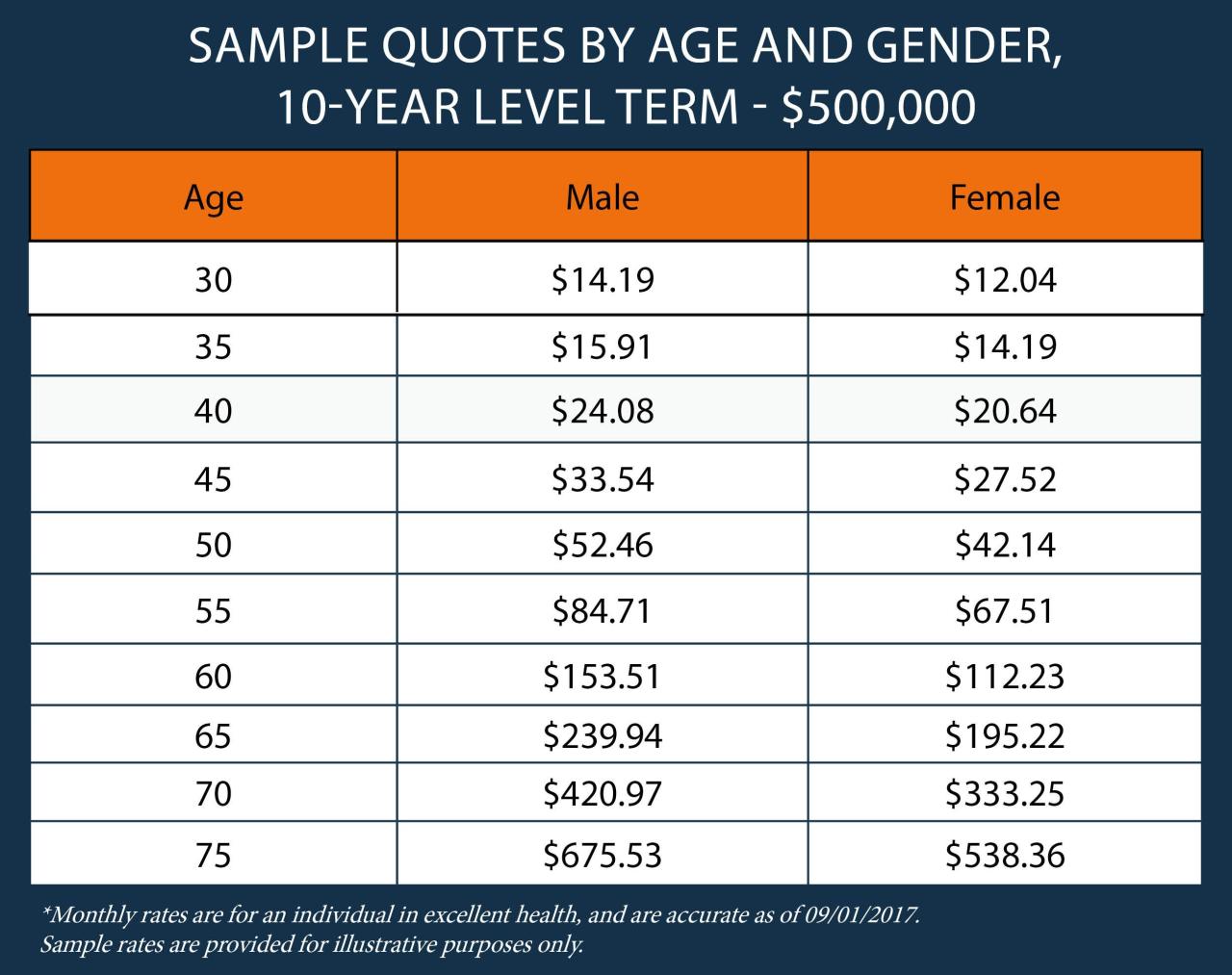

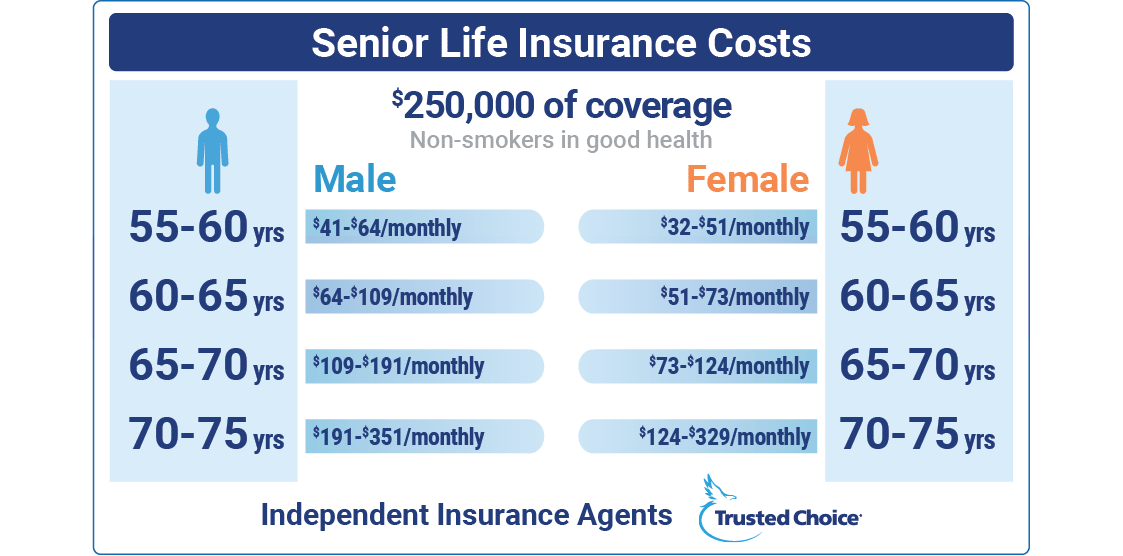

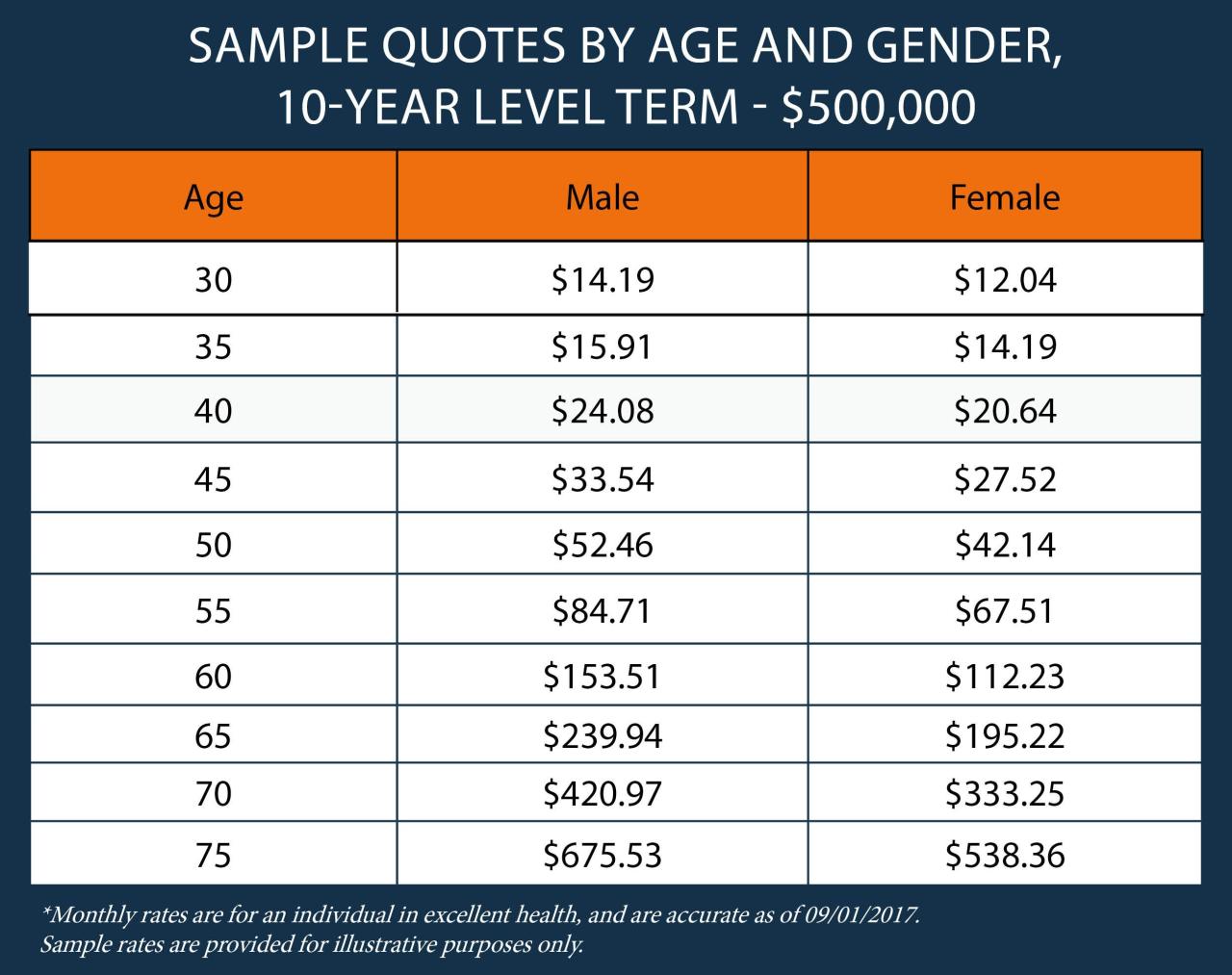

Term life insurance rates for seniors are influenced by various factors, including their age, health, lifestyle, and the amount of coverage they seek. Understanding how these factors impact premium calculations is crucial for seniors seeking suitable and affordable life insurance.

Age

The age of the insured is a significant factor in determining term life insurance rates. As individuals age, their life expectancy decreases, making them more likely to pass away during the policy term. Consequently, insurance companies charge higher premiums to seniors to account for the increased risk. For instance, a 65-year-old individual will generally pay a higher premium than a 55-year-old individual for the same coverage amount and policy term.

Health

The health status of the insured significantly impacts term life insurance rates. Individuals with pre-existing health conditions, such as heart disease, diabetes, or cancer, are considered higher risk by insurance companies. As a result, they are likely to pay higher premiums. Conversely, individuals with good health and no significant medical history may qualify for lower rates.

Lifestyle

An individual’s lifestyle choices, such as smoking, alcohol consumption, and participation in risky activities, can influence term life insurance rates. Insurance companies may charge higher premiums to individuals who engage in habits that increase their risk of death. For example, smokers are generally charged higher premiums than non-smokers due to their increased risk of lung cancer and other smoking-related diseases.

Coverage Amount

The amount of coverage chosen also impacts term life insurance rates. Higher coverage amounts typically result in higher premiums, as the insurance company assumes a greater financial obligation in the event of the insured’s death. Seniors may need a higher coverage amount to cover their final expenses, such as funeral costs, outstanding debts, and financial support for dependents.

Table of Factors Affecting Term Life Insurance Rates for Seniors

| Factor | Description | Impact on Rates |

|---|---|---|

| Age | The age of the insured individual. | Older individuals generally pay higher premiums due to their decreased life expectancy. |

| Health | The overall health status of the insured, including pre-existing medical conditions. | Individuals with pre-existing health conditions are considered higher risk and may pay higher premiums. |

| Lifestyle | Habits and activities that influence the insured’s risk of death, such as smoking, alcohol consumption, and participation in risky activities. | Individuals with riskier lifestyles may face higher premiums. |

| Coverage Amount | The amount of death benefit provided by the insurance policy. | Higher coverage amounts generally result in higher premiums. |

Common Health Conditions and Their Impact on Rates

Term life insurance rates for seniors are heavily influenced by their health status. Individuals with pre-existing conditions often face higher premiums, as insurers assess the increased risk of potential claims. Understanding the impact of specific health conditions on rates is crucial for seniors seeking life insurance.

Health Conditions that May Lead to Higher Premiums

Seniors with certain health conditions may encounter higher premiums due to the increased risk they present to insurers. These conditions often indicate a higher likelihood of early mortality, requiring insurers to charge more to cover the potential claims.

- Cardiovascular Disease: Conditions like heart disease, stroke, and high blood pressure significantly increase the risk of premature death. Insurers often consider these conditions as high-risk factors, leading to higher premiums.

- Diabetes: Individuals with diabetes, both type 1 and type 2, face increased mortality rates due to complications related to the disease. This elevated risk is reflected in higher premiums for life insurance.

- Cancer: A history of cancer or a current diagnosis can significantly impact life insurance rates. The type of cancer, stage of the disease, and treatment history are all factors considered by insurers.

- Chronic Obstructive Pulmonary Disease (COPD): This lung disease, characterized by difficulty breathing, can lead to higher premiums due to the increased risk of respiratory complications and premature death.

- Kidney Disease: Chronic kidney disease can significantly impact life expectancy, leading to higher premiums. Insurers may also consider the stage of kidney disease and the need for dialysis or transplant.

- Obesity: Individuals with a high Body Mass Index (BMI) are often considered higher risk for various health issues, including cardiovascular disease, diabetes, and certain types of cancer. Insurers may adjust premiums based on BMI.

- Mental Health Conditions: While mental health conditions themselves don’t directly impact mortality, some associated behaviors or complications might. Insurers may consider the severity of the condition and its potential impact on health and longevity.

Improving Health to Potentially Lower Rates

Seniors can take proactive steps to improve their health and potentially lower their life insurance premiums. While some health conditions may be pre-existing, others can be managed through lifestyle changes and medical interventions.

- Maintain a Healthy Weight: Losing excess weight can reduce the risk of developing or worsening many chronic conditions, such as diabetes, heart disease, and some cancers.

- Regular Exercise: Engaging in regular physical activity improves cardiovascular health, strengthens muscles and bones, and can help manage weight.

- Healthy Diet: Consuming a balanced diet rich in fruits, vegetables, and whole grains can lower the risk of developing chronic diseases.

- Quit Smoking: Smoking significantly increases the risk of various health problems, including heart disease, stroke, and lung cancer. Quitting smoking can significantly improve health and potentially lower life insurance premiums.

- Manage Stress: Chronic stress can negatively impact health. Techniques like meditation, yoga, or deep breathing can help manage stress and promote well-being.

- Regular Medical Checkups: Routine medical checkups and screenings can help detect health issues early, allowing for timely treatment and improving overall health outcomes.

Comparing Term Life Insurance Quotes for Seniors

Shopping for term life insurance as a senior can feel overwhelming, especially when you’re faced with a multitude of insurers and policies. It’s crucial to compare quotes from multiple insurers to find the best deal that suits your needs and budget.

Comparing Quotes from Multiple Insurers

Comparing quotes from several insurers is essential to ensure you’re getting the most competitive rate. Each insurer uses its own proprietary underwriting process, which considers factors like age, health, and lifestyle. These differences can lead to significant variations in premiums.

Evaluating Quotes Beyond the Premium

While the premium is an important factor, it’s not the only one to consider when evaluating quotes. Seniors should look beyond the premium and assess the following:

- Coverage Amount: The coverage amount should be sufficient to meet your financial goals, such as covering funeral expenses, outstanding debts, or providing financial support to loved ones.

- Policy Term: The term of the policy should align with your coverage needs. For example, if you need coverage for a specific period, like paying off a mortgage, a shorter term may be more cost-effective.

- Riders: Riders are optional add-ons that can enhance your policy’s coverage. Consider riders like accidental death benefits or terminal illness benefits to ensure comprehensive protection.

- Financial Stability of the Insurer: Choose a financially sound insurer with a strong track record of paying claims. You can check the insurer’s financial ratings with independent agencies like A.M. Best or Moody’s.

- Customer Service and Reputation: Look for an insurer with a reputation for excellent customer service and a responsive claims process.

Example Table for Comparing Quotes

To facilitate the comparison process, consider using a table like the one below:

| Insurer | Coverage Amount | Premium | Key Features |

|---|---|---|---|

| Insurer A | $250,000 | $50/month | 10-year term, accidental death benefit, guaranteed renewable |

| Insurer B | $250,000 | $45/month | 20-year term, terminal illness benefit, waiver of premium |

| Insurer C | $250,000 | $40/month | 15-year term, no riders, non-renewable |

This table helps you visualize the key differences between quotes and identify the best fit for your individual needs.

Finding Affordable Term Life Insurance for Seniors

Securing affordable term life insurance as a senior can seem challenging, but it’s achievable with careful planning and a strategic approach. By understanding the factors influencing rates and exploring available options, seniors can find coverage that fits their needs and budget.

Strategies to Reduce Premiums

Finding the right term life insurance policy at an affordable price is a top priority for seniors. Several strategies can help lower premiums, allowing seniors to secure coverage without straining their finances.

- Choose a Shorter Policy Term: A shorter policy term, such as 10 or 15 years, typically results in lower premiums compared to longer terms. This approach can be particularly beneficial for seniors seeking coverage for a specific purpose, such as paying off a mortgage or covering final expenses, and are confident they won’t need coverage beyond that timeframe.

- Increase the Deductible: A higher deductible means the insurance company pays out less in the event of a claim, leading to lower premiums. Seniors who are confident in their financial stability and have adequate savings may consider increasing their deductible to reduce monthly costs.

- Consider a Non-Smoker Rate: For seniors who have quit smoking, securing a non-smoker rate can significantly reduce premiums. This demonstrates a commitment to a healthier lifestyle and reduces the perceived risk for insurance companies.

- Bundle Policies: Some insurance companies offer discounts when multiple policies, such as home, auto, and life insurance, are bundled together. This can lead to significant savings for seniors who have other insurance needs.

- Shop Around for Quotes: Comparing quotes from different insurers is crucial to finding the most affordable option. Online comparison tools and independent insurance agents can simplify this process, enabling seniors to quickly and easily compare rates from various providers.

Important Considerations for Seniors

As individuals age, their life circumstances, health, and financial needs evolve. It’s crucial for seniors to regularly review their insurance needs to ensure they have adequate coverage for their current situation.

Reviewing Insurance Needs Regularly

Regularly reviewing insurance needs is vital for seniors. As they age, their health, financial status, and family situations may change, impacting their insurance requirements.

A comprehensive review of insurance needs should be conducted at least annually, or more frequently if significant life changes occur.

Changes Impacting Insurance Requirements

Several factors can affect seniors’ insurance needs:

- Health Changes: As individuals age, their health may deteriorate, increasing the likelihood of needing medical care. This may necessitate adjustments to health insurance coverage, such as adding supplemental policies or increasing coverage limits.

- Financial Changes: Retirement, changes in income, or unexpected expenses can impact seniors’ ability to afford insurance premiums. Reviewing coverage and exploring cost-effective options is essential.

- Family Circumstances: Changes in family structure, such as the death of a spouse or the arrival of grandchildren, can alter insurance needs. For example, a surviving spouse may need additional life insurance to cover financial obligations or ensure the continuation of their lifestyle.

Evaluating Insurance Needs

Seniors should ask themselves the following questions when evaluating their insurance needs:

- What are my current financial obligations? This includes mortgage payments, outstanding debts, and any ongoing expenses.

- How much income would my family need if I passed away? Consider replacing lost income, covering funeral expenses, and providing financial security for dependents.

- What are my current health insurance coverage limits? Are they sufficient to cover potential medical expenses?

- Do I have enough long-term care insurance? This is essential to protect against the high costs of nursing homes or assisted living facilities.

- What are my current insurance premiums? Can I afford them, or do I need to explore more affordable options?

- Are my beneficiaries up-to-date? Ensure your insurance policies reflect your current wishes and beneficiaries.

Alternatives to Term Life Insurance for Seniors

While term life insurance is a cost-effective option for many seniors, it may not be the best choice for everyone. There are several alternatives to term life insurance that seniors can consider, each with its own advantages and disadvantages.

Whole Life Insurance

Whole life insurance provides permanent coverage for your entire life, as long as you pay your premiums. It also builds cash value that you can borrow against or withdraw.

Benefits of Whole Life Insurance

- Permanent Coverage: Whole life insurance provides lifelong coverage, ensuring your beneficiaries will receive a death benefit regardless of when you pass away.

- Cash Value Accumulation: A portion of your premium goes towards building cash value, which grows over time. You can borrow against this cash value or withdraw it, subject to certain conditions.

- Potential for Investment Growth: Whole life insurance policies often have a cash value component that is invested in the insurer’s general account. While returns are not guaranteed, they can potentially outpace inflation over the long term.

- Tax Advantages: Death benefits from whole life insurance are generally tax-free for beneficiaries.

Drawbacks of Whole Life Insurance

- Higher Premiums: Whole life insurance premiums are typically higher than term life insurance premiums because they cover both the death benefit and the cash value component.

- Limited Flexibility: Whole life insurance policies are less flexible than term life insurance policies. You cannot adjust the death benefit or coverage period once the policy is issued.

- Potential for Investment Risk: While the cash value component of whole life insurance can grow over time, it is also subject to investment risk.

- Complex Policies: Whole life insurance policies can be complex and difficult to understand.

Suitability for Seniors

Whole life insurance can be a suitable option for seniors who want permanent coverage and the potential for cash value accumulation. It can also be a good choice for seniors who want to leave a legacy for their heirs. However, it is important to weigh the higher premiums and complexity of whole life insurance against the benefits.

Final Expense Insurance

Final expense insurance, also known as burial insurance, is designed to cover the costs associated with death, such as funeral expenses, burial costs, and outstanding medical bills.

Benefits of Final Expense Insurance

- Specific Coverage: Final expense insurance provides a fixed death benefit that is specifically designed to cover end-of-life expenses.

- Guaranteed Acceptance: Some final expense insurance policies are guaranteed issue, meaning they are available to seniors regardless of their health condition.

- Affordable Premiums: Final expense insurance policies typically have lower premiums than whole life insurance policies, making them more affordable for seniors on a fixed income.

Drawbacks of Final Expense Insurance

- Limited Coverage: Final expense insurance policies typically have lower death benefits than whole life insurance policies, and they may not cover all end-of-life expenses.

- Short Coverage Period: Final expense insurance policies often have a limited coverage period, such as 10 or 20 years.

- High Interest Rates: Some final expense insurance policies have high interest rates on loans against the cash value.

Suitability for Seniors

Final expense insurance can be a suitable option for seniors who want to ensure their loved ones can afford to cover their end-of-life expenses. It is a good choice for seniors who are concerned about leaving a financial burden on their family. However, it is important to consider the limited coverage and potential high interest rates.

Long-Term Care Insurance

Long-term care insurance helps cover the costs of long-term care services, such as assisted living, nursing home care, and in-home care.

Benefits of Long-Term Care Insurance

- Financial Protection: Long-term care insurance can help protect your assets from being depleted by the high costs of long-term care.

- Choice of Care: Long-term care insurance gives you more control over where and how you receive care.

- Peace of Mind: Long-term care insurance can provide peace of mind knowing that your long-term care expenses will be covered.

Drawbacks of Long-Term Care Insurance

- High Premiums: Long-term care insurance premiums can be expensive, especially for seniors who are older or have pre-existing health conditions.

- Limited Coverage: Long-term care insurance policies may have limits on the amount of coverage and the duration of benefits.

- Complex Policies: Long-term care insurance policies can be complex and difficult to understand.

Suitability for Seniors

Long-term care insurance can be a suitable option for seniors who are concerned about the costs of long-term care. It is a good choice for seniors who have a family history of long-term care needs or who have a significant net worth that they want to protect. However, it is important to weigh the high premiums and limited coverage against the benefits.

Resources for Seniors Seeking Term Life Insurance

Navigating the world of term life insurance can be overwhelming, especially for seniors. Fortunately, several resources are available to help seniors make informed decisions about their coverage. These resources can provide valuable information, tools, and support to ensure seniors understand their options and find the best policy for their needs.

Consumer Advocacy Groups

Consumer advocacy groups play a vital role in protecting consumers’ rights and providing unbiased information about various products and services, including insurance. These organizations often conduct research, publish reports, and offer educational materials to help consumers make informed choices.

- National Council on Aging (NCOA): This non-profit organization offers resources and programs for seniors, including information on insurance and financial planning. They provide free publications, online resources, and a helpline for seniors to address their questions and concerns. Website: https://www.ncoa.org/

- AARP: The American Association of Retired Persons (AARP) provides resources and advocacy for seniors, including information on insurance and financial planning. They offer publications, online resources, and workshops to help seniors understand their options and make informed decisions. Website: https://www.aarp.org/

- Consumer Reports: This non-profit organization conducts independent testing and research on various products and services, including insurance. They publish ratings and reviews of insurance companies, helping consumers compare options and make informed choices. Website: https://www.consumerreports.org/

Insurance Comparison Websites

Insurance comparison websites offer a convenient way for seniors to compare quotes from multiple insurance companies simultaneously. These websites allow users to enter their information, such as age, health, and desired coverage, and receive customized quotes from different insurers.

- Policygenius: This website compares quotes from multiple insurance companies for various insurance products, including term life insurance. They offer a user-friendly platform and provide personalized recommendations based on individual needs. Website: https://www.policygenius.com/

- The Zebra: This website compares quotes from multiple insurance companies for various insurance products, including term life insurance. They offer a comprehensive comparison tool and provide insights into different insurance policies. Website: https://www.thezebra.com/

- Insurify: This website compares quotes from multiple insurance companies for various insurance products, including term life insurance. They offer a user-friendly interface and provide personalized recommendations based on individual needs. Website: https://www.insurify.com/

Government Agencies

Government agencies provide information and resources for consumers, including seniors, regarding insurance and financial planning. These agencies often offer guidance on navigating the insurance market and protecting consumers from scams.

- National Association of Insurance Commissioners (NAIC): This organization represents insurance regulators from all 50 states, the District of Columbia, and five U.S. territories. They provide resources and information for consumers, including information on insurance regulations and consumer protection. Website: https://www.naic.org/

- Federal Trade Commission (FTC): This agency protects consumers from unfair, deceptive, or fraudulent business practices. They provide information and resources for consumers, including guidance on avoiding insurance scams and understanding their rights. Website: https://www.ftc.gov/

Seeking Professional Advice

While online resources and consumer advocacy groups can provide valuable information, seeking professional advice from an insurance agent can be highly beneficial. A qualified insurance agent can:

- Assess individual needs: An insurance agent can assess a senior’s specific needs and financial situation to determine the best type and amount of coverage.

- Compare policies: An agent can compare policies from different insurance companies, ensuring seniors receive the most competitive rates and coverage options.

- Explain complex terms: An agent can explain complex insurance terms and concepts, ensuring seniors understand the details of their policy.

- Provide ongoing support: An agent can provide ongoing support and guidance throughout the policy lifecycle, answering questions and addressing concerns.

Tips for Seniors to Secure Term Life Insurance

Securing term life insurance as a senior can be a straightforward process if you follow the right steps. This guide provides practical advice to help you navigate the application process, understand health disclosures, and secure the best possible coverage and rates.

Preparing for the Application Process

Before applying for term life insurance, take the time to prepare thoroughly. This ensures a smooth application process and helps you get the best possible rates.

- Gather Necessary Documents: To streamline the application process, have the following documents readily available:

- Social Security Number: This is essential for verifying your identity and obtaining accurate quotes.

- Driver’s License or Other Government-Issued ID: This is used to confirm your identity and address.

- Medical Records: Be prepared to provide details about your medical history, including any current medications and recent medical tests.

- Financial Information: You may need to provide information about your income and assets, especially if you are applying for a large policy.

- Understand Health Disclosures: Be prepared to disclose any health conditions you may have. Honesty is crucial. Providing inaccurate information could lead to your application being denied or your policy being voided later.

- Pre-Existing Conditions: Be prepared to discuss any pre-existing conditions, such as diabetes, heart disease, or cancer.

- Recent Medical Tests: You may need to provide information about recent medical tests, including blood work, imaging scans, and biopsies.

- Consider a Medical Exam: Some insurance companies may require a medical exam, especially for seniors. This involves a physical examination by a doctor, which can include blood work and other tests.

- Purpose: The medical exam helps the insurance company assess your overall health and determine your risk level.

- Preparation: Make sure you are well-rested and hydrated before the exam. You may also want to bring a list of your current medications and medical history.

Negotiating with Insurers

Once you have gathered the necessary information and prepared for the application process, you can start contacting insurance companies.

- Shop Around: Get quotes from multiple insurance companies to compare rates and coverage options.

- Online Comparison Tools: Use online comparison tools to quickly get quotes from various insurers.

- Independent Insurance Agents: Consider working with an independent insurance agent who can compare quotes from multiple companies on your behalf.

- Ask About Discounts: Many insurance companies offer discounts for seniors who are in good health or have certain lifestyle habits.

- Healthy Lifestyle Discounts: Some insurers offer discounts to seniors who are non-smokers, exercise regularly, and maintain a healthy weight.

- Group Discounts: If you are a member of a professional organization or senior group, you may be eligible for a discount.

- Negotiate Coverage and Rates: Don’t be afraid to negotiate with insurance companies to get the best possible coverage and rates.

- Consider Coverage Options: Explore different coverage options, such as term length, death benefit amount, and riders.

- Ask About Payment Options: Inquire about payment options, such as monthly premiums, annual premiums, or lump-sum payments.

Ending Remarks

Navigating term life insurance rates as a senior can seem daunting, but with the right information and guidance, finding affordable and suitable coverage is achievable. By understanding the factors that influence premiums, comparing quotes from multiple insurers, and exploring alternative options, seniors can make informed decisions that align with their individual needs and financial goals. Remember, securing a legacy and protecting loved ones is a testament to the enduring spirit of the golden years.